The adult children of the Baby Boom generation are taking longer to grow up. A 2019 Pew study...

How to Protect Your Own Financial Health When Helping Adult Children

Logical Steps

Here are ten ideas to think about when considering financial support for an adult child:

- It's important to carefully determine how much you can afford. Be especially cautious about protecting your retirement savings. It's one thing to free up money to help your kid by trimming your expenses. In contrast, if you draw from your retirement funds, you put your own future at risk.

- Think through how you prefer to manage the arrangement. Consider your needs along with your child's. Decisions around helping your child are overloaded with emotion. We all sacrifice for our children and want to help them in times of genuine need. At the same time, you want to nurture their growing self-sufficiency.

- One idea is to structure the arrangement as a loan rather than a gift, placing responsibility on their shoulders rather than creating a sense of entitlement. In the end, you can forgive the loan if necessary. However, a gift, once given, can rarely be gracefully reversed.

- Meet face-to-face with your adult child to discuss the situation beforehand. Long-distance communications leave more room for misunderstandings.

- Most of the time, these arrangements are temporary. Both parties should mutually agree on the conditions under which the arrangement ends.

- Think through the details of the arrangement. If, for example, you will be babysitting part-time for grandkids, think about the various scenarios and state what you are willing to do. Also, both parties should reserve the right to request changes once the arrangement is underway.

- If help takes the form of an adult child moving in with you to save money, both parties must be clear about the ground rules. For example, what responsibilities does the "tenant" have around the house? Remember that your new housemate may have gotten used to much freedom after leaving home initially. Be aware that this "kid" isn't twelve anymore, and you'll probably need to monitor your behavior to avoid being overly paternalistic. On the other hand, your kid needs to realize they are no longer a "kid" and must act like a responsible adult.

- Once you agree on the details, put everything in a document both parties sign. It will be helpful to have this for future reference rather than relying on memory.

- Refer your adult child to resources for budgeting and financial planning. Many books, online resources, and classes are available for young people to learn about being financially independent.

- Providing referrals to financial coaches, financial planners, and accountants can bring knowledgeable and objective professionals* into the mix. As neutral third parties, they don't have the emotional baggage that builds up in a parent-child relationship. It can be ironic that your adult kid readily heeds advice from such a stranger, even though you've offered the same wisdom many times in the past.

Post-Boomer generations need help equaling the widespread affluence of the post-WWII cohort. Many Boomers, therefore, are inclined to devote some of their wealth to helping their adult children. In doing so, they need to be savvy about how much help to give and how to deliver it so they don't overtax their resources and prevent a sense of entitlement among their beneficiaries.

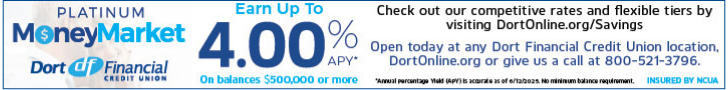

Jumpstart your savings!